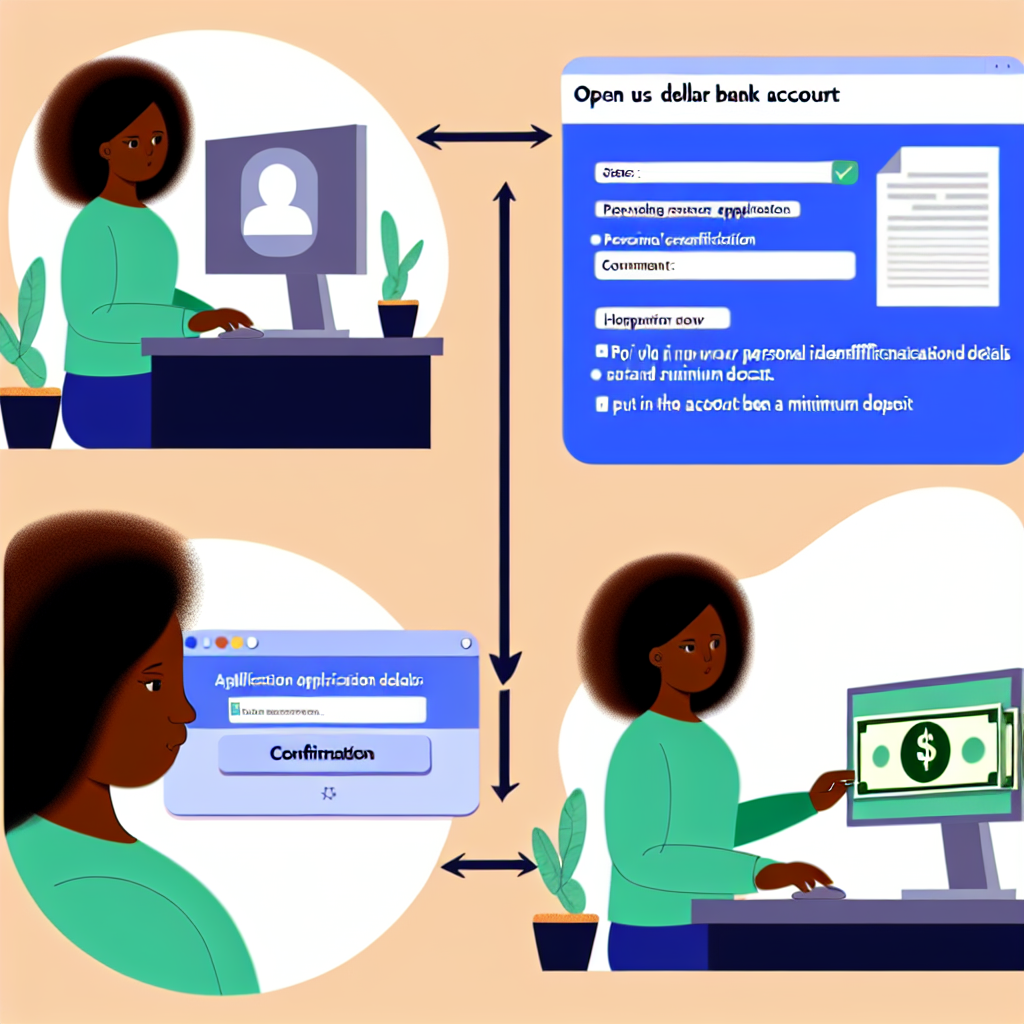

How To Open a US Dollar Bank Account From Nigeria

Opening a US Dollar bank account from Nigeria can be a convenient way to manage international transactions, receive payments in US currency, and diversify your financial holdings. While it may seem like a complex process, with the right information and guidance, you can successfully open and manage a US Dollar account from Nigeria.

Research Different Banks

Before deciding on a bank to open a US Dollar account with, it’s essential to research and compare the different options available. Look for banks that offer US Dollar accounts to international customers and compare their account requirements, fees, minimum balance requirements, and other features that may be important to you.

Prepare Required Documents

Once you have selected a bank, you will need to prepare the required documents for opening a US Dollar account. Typically, you will need to provide proof of identity, such as a valid passport or national ID card, proof of address, and possibly additional documents depending on the bank’s specific requirements.

Visit the Bank or Apply Online

Depending on the bank’s policies, you may be able to open a US Dollar account by visiting a branch in person or by applying online through the bank’s website. If applying in person, make sure to bring all the necessary documents with you. If applying online, follow the bank’s instructions for submitting the required documents digitally.

Deposit Funds

After your account application is approved, you will need to deposit funds into your US Dollar account. This can typically be done through wire transfer, online transfer, or by depositing cash or a check at the bank. Some banks may have minimum initial deposit requirements, so make sure to check this beforehand.

Manage Your Account

Once your US Dollar account is open and funded, you can start using it to send and receive US Dollar payments, make international transactions, and manage your finances in a different currency. Be sure to monitor your account regularly, set up any necessary notifications or alerts, and familiarize yourself with the bank’s online banking platform for easy account management.

Understand Fees and Exchange Rates

It’s important to understand the fees associated with your US Dollar account, including account maintenance fees, transaction fees, and currency conversion fees. Additionally, be aware of the exchange rates used by the bank for converting currency, especially when making international transactions or transferring funds between your US Dollar account and other accounts.

Consider Tax Implications

Opening and maintaining a US Dollar account as a Nigerian resident may have tax implications, especially if you earn interest on your account balance or engage in regular foreign exchange transactions. It’s advisable to consult with a tax advisor or financial expert to understand any potential tax obligations and ensure compliance with Nigerian and US tax laws.

Conclusion

Opening a US Dollar bank account from Nigeria can provide you with greater flexibility in managing your finances, conducting international transactions, and holding funds in a stable foreign currency. By following the steps outlined above and staying informed about the requirements and considerations involved, you can successfully open and maintain a US Dollar account to meet your financial needs.